5 Best Mortgage Processing Software in 2025

Mortgage origination is paperwork-heavy and full of potential mistakes. Delays hurt both lenders and borrowers. Mortgage processing software handles applications from start to finish. It automates document collection, credit checks, and compliance to speed approvals and cut costs.

This guide covers the top mortgage processing software in 2025, highlighting features, pricing, and who each platform works best for.

Key Benefits of Using Mortgage Processing Software

- Faster processing: Less manual work, quicker approvals.

- Lower costs: Saves on paper, storage, and labor.

- Better compliance: Automated checks reduce legal risk.

- Happier borrowers: Online portals simplify the experience.

- Better data: Centralized storage improves accuracy and decisions.

Best Mortgage Processing Software in 2025

1. LenderLogix – Streamline Point-of-Sale Loan Processing

LenderLogix is a modern digital mortgage platform built to simplify the borrower experience and integrate point-of-sale (POS) workflows for lenders of all sizes. It ties together initial borrower interaction, credit checks, underwriting automation, and document collection in one interface, reducing hand-offs and friction. Its API-first design supports integrations with third-party verification services. The platform focuses on minimizing manual tasks, shortening approval times, and improving engagement at the front end of origination. LenderLogix is ideal for small to mid-sized lenders seeking a smooth, efficient point-of-sale experience.

- Key Features: Automated Loan Application, Document Management, Compliance Tools, Credit Reporting Integration, Automated Underwriting

- Pricing: Starts at $300/month (Premium & Enterprise custom)

- Best For: Small to mid-sized lenders wanting a streamlined POS-first solution

2. Calyx Point – Complete Loan Origination Made Easy

Calyx Point is a full-featured loan origination system designed for mortgage brokers, banks, and credit unions. It covers every stage from prequalification to closing with cloud-native modules for lead capture, origination, underwriting, and document management. Built-in compliance workflows help lenders stay aligned with regulations, and its 200+ integrated vendor connections simplify third-party interactions. Calyx emphasizes quick deployment and standardized templates to reduce setup costs and complexity. Its platform is scalable, supporting growing lenders without needing extensive IT support, making it a trusted choice for full lifecycle loan management.

- Pricing: Starts at $400/month (Premium & Enterprise custom)

3. Ellie Mae Encompass – Enterprise-Level Mortgage Solutions

Encompass by ICE Mortgage Technology is designed for high-volume and enterprise lenders. It manages the full mortgage lifecycle, including application, underwriting, closing, and delivery. The platform offers advanced automation, business intelligence tools, and numerous integrations to enhance efficiency and reduce errors. Research shows Encompass can improve loan production and reduce cycle times, making it suitable for lenders handling complex and high-volume operations. While implementation is more involved, the platform’s enterprise-grade scalability and comprehensive feature set justify the investment for large organizations.

- Pricing: Starts at $500/month (Premium & Enterprise custom)

4. OpenClose – Customizable Loan Management Platform

OpenClose provides a fully browser-based LOS and POS platform that emphasizes flexibility. Lenders can customize workflows, branding, and digital borrower journeys without heavy IT resources. OpenClose integrates with multiple third-party vendors and offers workflow automation and analytics to reduce operational costs and improve turnaround times. Its configurability allows banks, credit unions, and mortgage brokers to tailor the system to unique business processes, making it easier to adapt to changing regulations and borrower expectations.

- Pricing: Starts at $350/month (Premium & Enterprise custom)

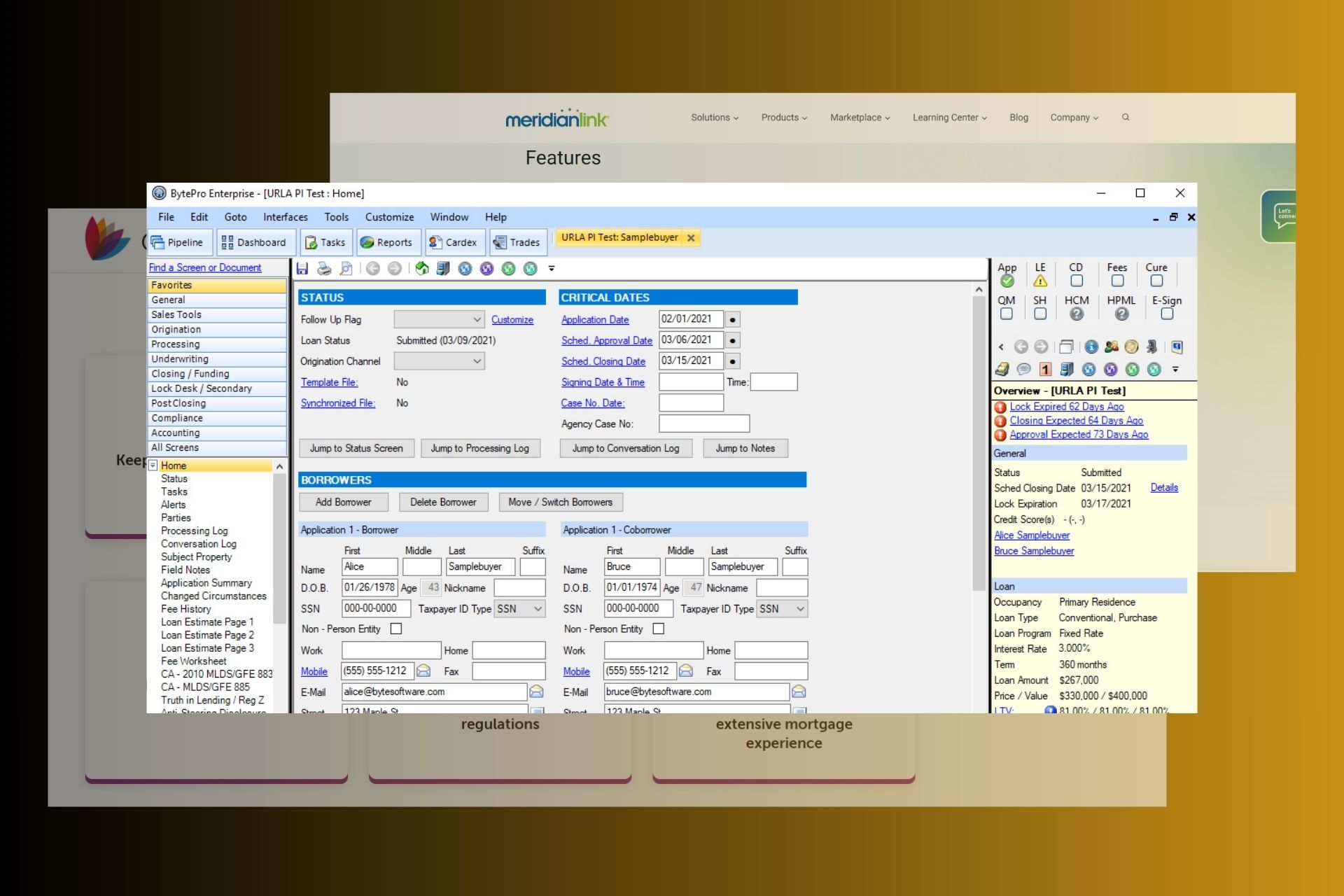

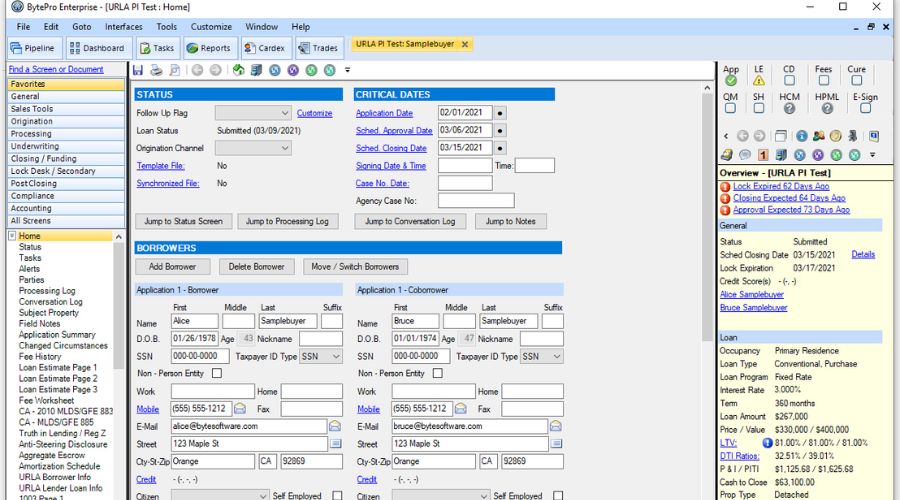

5. Byte Software – Simple and User-Friendly Lending

Byte Software focuses on simplicity and usability. It delivers core LOS features such as loan application, document management, underwriting, and compliance, all in a user-friendly interface. The platform is ideal for small lenders and brokers who want quick deployment and minimal training. Byte Software reduces manual errors with automated checks and validation tools, streamlines workflows, and supports electronic signatures. Its intuitive design allows teams to work efficiently without the complexity of larger enterprise solutions, making it a practical choice for lenders prioritizing ease of use.

- Pricing: Starts at $250/month (Premium & Enterprise custom)

Wrap Up

Mortgage processing software is transforming how lenders manage loan origination. By automating document collection, credit checks, compliance, and workflow management, these platforms reduce errors, save time, and improve the borrower experience. Whether you are a small broker, mid-sized lender, or enterprise organization, there’s a solution tailored to your needs—from LenderLogix’s streamlined POS experience to Encompass’s enterprise-level capabilities. Investing in the right software not only speeds approvals but also strengthens compliance and operational efficiency, making it an essential tool for modern mortgage lending.

Frequently Asked Questions (FAQ)

Mortgage processing software automates the loan origination process, including application intake, document management, underwriting, compliance checks, and borrower communication.

Brokers, banks, credit unions, and lenders of all sizes can benefit. Small lenders may prioritize ease of use, while enterprises need scalability and advanced automation.

Pricing varies by platform and features. Most solutions start between $250–$500/month, with custom plans available for enterprise users.

Yes. Automated document handling, credit checks, and compliance workflows significantly reduce manual errors and legal risks.

Most leading solutions offer APIs and pre-built integrations with credit bureaus, verification services, and third-party vendors to streamline operations.

User forum

0 messages