10 Best Do It Yourself Payroll Software

Managing payroll can be a significant burden for small business owners. From calculating wages and taxes to ensuring timely payments and compliance, the process can be complex and time-consuming. This is especially true given the ever-changing landscape of tax regulations and employment laws, making accurate and efficient payroll management crucial for business success and employee satisfaction.

This article presents a curated list of ten do-it-yourself payroll software solutions designed to simplify payroll processing for small to medium-sized businesses. We’ll explore each platform’s core capabilities, key features, pricing, and ideal use cases. These payroll management tools offer functionalities such as automated tax calculations, direct deposit, employee self-service portals, and comprehensive reporting, enabling business owners to handle payroll tasks effectively and remain compliant with regulatory requirements.

Why is do it yourself payroll software needed?

The necessity for do-it-yourself payroll software stems from several challenges faced by businesses. Many companies, especially startups and small to medium-sized enterprises (SMEs), grapple with the complexities of payroll administration.

- Incorrect payroll calculations lead to penalties and legal issues, eroding profitability.

- Manual payroll processes are time-intensive, diverting resources from core business activities.

- Lack of compliance with evolving tax laws results in fines and reputational damage.

- Inadequate data security exposes sensitive employee information to potential breaches.

- Limited access to real-time payroll data hinders informed decision-making and financial planning.

Do-it-yourself payroll software offers a streamlined, automated solution to these problems. By automating calculations, ensuring compliance, and providing secure data management, these platforms empower businesses to manage payroll efficiently and accurately. These tools are becoming increasingly vital for businesses seeking to optimize their operations and maintain a competitive edge in 2025.

Key Features to Look For

When selecting do-it-yourself payroll software, several key features should be considered to ensure it meets the specific needs of your business.

Automated Tax Calculations: This feature automatically calculates federal, state, and local taxes, reducing the risk of errors and ensuring compliance with tax regulations. Accurate tax calculations are crucial for avoiding penalties and maintaining financial stability.

Direct Deposit: Direct deposit allows you to pay employees electronically, eliminating the need for paper checks and streamlining the payment process. This saves time and resources while providing a convenient payment method for employees.

Employee Self-Service Portal: An employee self-service portal enables employees to access their pay stubs, W-2 forms, and other payroll-related information online. This reduces the administrative burden on HR staff and empowers employees to manage their own information.

Comprehensive Reporting: Robust reporting capabilities provide insights into payroll data, allowing you to track expenses, analyze trends, and make informed business decisions. Detailed reports are essential for financial planning and compliance audits.

Compliance Management: The software should automatically update with the latest tax laws and regulations, ensuring your business remains compliant with all applicable laws. This reduces the risk of penalties and legal issues.

Benefits

Implementing do-it-yourself payroll software can bring several advantages to businesses, enhancing efficiency, accuracy, and overall financial management.

Reduced Errors: Automated calculations and compliance features minimize the risk of errors in payroll processing, leading to more accurate paychecks and tax filings. This reduces the potential for costly penalties and legal issues.

Time Savings: Automating payroll tasks such as calculating wages, taxes, and deductions frees up valuable time for business owners and HR staff. This allows them to focus on more strategic initiatives and core business activities.

Improved Compliance: Keeping up with ever-changing tax laws and regulations can be challenging. Payroll software automates compliance, ensuring your business adheres to all applicable laws and regulations.

Enhanced Data Security: Payroll software provides secure storage and management of sensitive employee data, protecting against data breaches and unauthorized access. This helps maintain employee trust and protects the business from potential legal liabilities.

Cost-Effectiveness: While there is an initial investment in payroll software, the long-term cost savings from reduced errors, time savings, and improved compliance can be significant. Many platforms offer scalable pricing plans to suit businesses of all sizes.

What Are the Top DIY Payroll Solutions?

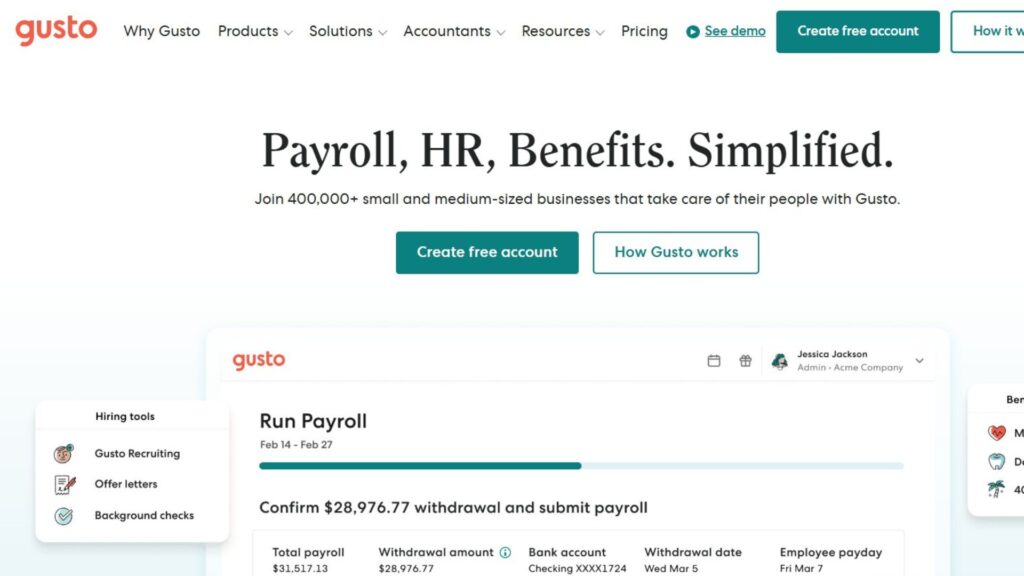

Gusto – Best for Small Businesses with Growing Teams

Gusto is a popular payroll platform known for its user-friendly interface and comprehensive features tailored for small businesses. It simplifies payroll processing, tax compliance, and benefits administration, making it an ideal choice for businesses seeking an all-in-one HR solution. Gusto’s intuitive design and robust functionality make it accessible to business owners with limited payroll experience.

Gusto automates payroll calculations, tax filings, and employee payments, reducing the risk of errors and ensuring compliance with federal, state, and local regulations. The platform also offers direct deposit, employee self-service portals, and customizable reports. Its integration with accounting software such as QuickBooks and Xero streamlines financial management and provides real-time insights into payroll expenses.

Beyond payroll, Gusto offers a range of HR features including benefits administration, time tracking, and employee onboarding tools. These additional functionalities enhance employee management and contribute to a more efficient and engaged workforce. Gusto also provides access to HR experts and compliance resources, offering support for businesses navigating complex employment laws.

Unlike Paychex, which is geared toward larger businesses with more complex payroll needs, Gusto is designed specifically for small to medium-sized enterprises (SMEs). While ADP offers a broader range of HR services, Gusto provides a more streamlined and affordable solution for businesses primarily focused on payroll and basic HR functions.

Key Features:

- Automated payroll processing for accurate and timely payments.

- Tax filing and compliance management to avoid penalties and legal issues.

- Direct deposit and employee self-service portals for convenience and efficiency.

- Benefits administration for managing health insurance, retirement plans, and other benefits.

- Time tracking integration to streamline payroll calculations.

- HR support and compliance resources for navigating employment laws.

Pricing:

Starting at $40/month + $6 per person

Free plan: No free plan

Premium: $80/month + $12 per person

Enterprise: Custom pricing

Best For: Small businesses with growing teams needing an all-in-one payroll and HR solution.

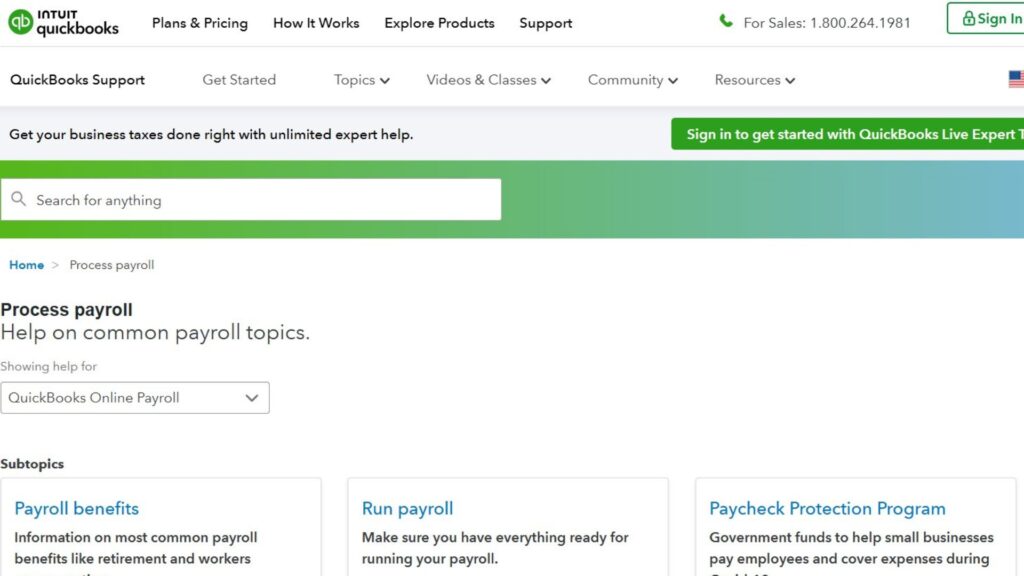

QuickBooks Payroll – Best for QuickBooks Users

QuickBooks Payroll is a payroll service designed to work seamlessly with QuickBooks accounting software. This integration simplifies payroll management for businesses already using QuickBooks, providing a unified platform for accounting and payroll tasks. It offers a range of features including automated payroll processing, tax filing, and employee payment options.

QuickBooks Payroll automates payroll calculations, tax deductions, and filings, reducing the risk of errors and ensuring compliance with tax regulations. It also offers direct deposit, employee self-service portals, and mobile access. The platform integrates seamlessly with QuickBooks Online and Desktop, allowing users to track payroll expenses, reconcile accounts, and generate financial reports from a single interface.

In addition to payroll, QuickBooks Payroll offers features such as time tracking, workers’ compensation administration, and HR support. These additional functionalities enhance employee management and compliance. The platform also provides access to payroll experts and resources, offering support for businesses navigating complex payroll issues.

Unlike Gusto, which offers a broader range of HR features, QuickBooks Payroll is primarily focused on payroll and its integration with QuickBooks accounting. While ADP provides a more comprehensive suite of HR services, QuickBooks Payroll offers a more streamlined and cost-effective solution for businesses already using QuickBooks.

Key Features:

- Automated payroll processing with accurate tax calculations.

- Tax filing and compliance management to avoid penalties.

- Direct deposit and employee self-service portals for convenience.

- Seamless integration with QuickBooks Online and Desktop.

- Time tracking integration for accurate payroll calculations.

- Workers’ compensation administration and HR support.

Pricing:

Starting at $45/month + $6 per person

Free plan: No free plan

Premium: $80/month + $12 per person

Enterprise: Custom pricing

Best For: Businesses already using QuickBooks accounting software looking for a streamlined payroll solution.

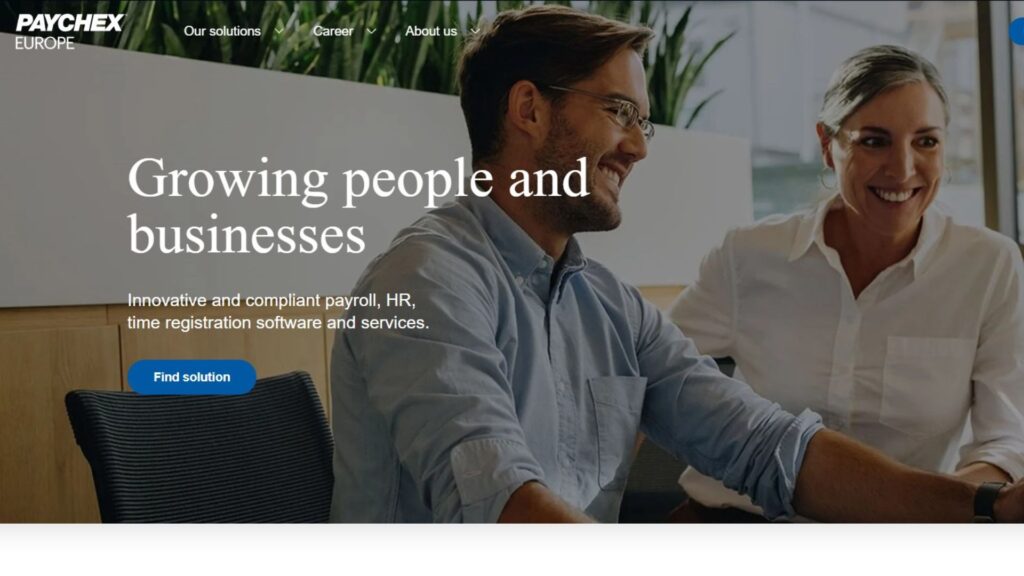

Paychex – Best for Medium to Large Businesses

Paychex is a comprehensive payroll and HR solution designed for medium to large businesses. It offers a wide range of services including payroll processing, tax administration, benefits administration, and HR support. Paychex’s scalable platform and extensive features make it a suitable choice for businesses with complex payroll needs.

Paychex automates payroll calculations, tax filings, and employee payments, reducing the risk of errors and ensuring compliance with federal, state, and local regulations. The platform also offers direct deposit, employee self-service portals, and customizable reports. Its integration with accounting software such as QuickBooks and Xero streamlines financial management and provides real-time insights into payroll expenses.

Beyond payroll, Paychex offers a range of HR services including benefits administration, time and attendance tracking, and HR consulting. These additional functionalities enhance employee management and contribute to a more efficient and engaged workforce. Paychex also provides access to HR experts and compliance resources, offering support for businesses navigating complex employment laws.

Unlike Gusto, which is tailored for small businesses, Paychex is designed to handle the complexities of medium to large enterprises. While QuickBooks Payroll offers a more streamlined solution for QuickBooks users, Paychex provides a broader range of HR services and scalability for growing businesses.

Key Features:

- Automated payroll processing for accurate and timely payments.

- Tax filing and compliance management to avoid penalties.

- Direct deposit and employee self-service portals for convenience.

- Benefits administration for managing health insurance and retirement plans.

- Time and attendance tracking for accurate payroll calculations.

- HR consulting and compliance resources for navigating employment laws.

Pricing:

Starting at $59/month + $4 per employee

Free plan: No free plan

Premium: Custom pricing

Enterprise: Custom pricing

Best For: Medium to large businesses with complex payroll and HR needs.

ADP – Best for Enterprises with Complex HR Needs

ADP (Automatic Data Processing) is a leading provider of payroll and HR solutions for businesses of all sizes, particularly large enterprises with complex HR requirements. It offers a comprehensive suite of services including payroll processing, tax administration, benefits administration, and HR management. ADP’s robust platform and global reach make it a suitable choice for multinational corporations.

ADP automates payroll calculations, tax filings, and employee payments, reducing the risk of errors and ensuring compliance with federal, state, and local regulations. The platform also offers direct deposit, employee self-service portals, and customizable reports. Its integration with accounting software such as SAP and Oracle streamlines financial management and provides real-time insights into payroll expenses.

Beyond payroll, ADP offers a wide range of HR services including talent management, workforce management, and HR outsourcing. These additional functionalities enhance employee management and contribute to a more efficient and engaged workforce. ADP also provides access to HR experts and compliance resources, offering support for businesses navigating complex employment laws.

Unlike Gusto, which is tailored for small businesses, ADP is designed to handle the complexities of large enterprises. While Paychex offers a comprehensive solution for medium to large businesses, ADP provides a more extensive suite of HR services and global capabilities.

Key Features:

- Automated payroll processing for accurate and timely payments.

- Tax filing and compliance management to avoid penalties.

- Direct deposit and employee self-service portals for convenience.

- Benefits administration for managing health insurance and retirement plans.

- Talent management and workforce management for optimizing employee performance.

- HR outsourcing and compliance resources for navigating employment laws.

Pricing:

Starting at Custom Pricing

Free plan: No free plan

Premium: Custom pricing

Enterprise: Custom pricing

Best For: Large enterprises with complex HR needs and global operations.

OnPay – Best for Industries with Unique Payroll Needs

OnPay is a payroll platform designed to cater to industries with unique payroll requirements, such as restaurants, farms, and non-profits. It offers specialized features and support for handling complex payroll scenarios, making it a suitable choice for businesses in these sectors. OnPay’s flexible platform and industry-specific expertise make it accessible to business owners with specific payroll challenges.

OnPay automates payroll calculations, tax filings, and employee payments, reducing the risk of errors and ensuring compliance with federal, state, and local regulations. The platform also offers direct deposit, employee self-service portals, and customizable reports. Its integration with accounting software such as QuickBooks and Xero streamlines financial management and provides real-time insights into payroll expenses.

In addition to payroll, OnPay offers features such as tip credit calculations, agricultural payroll support, and non-profit accounting tools. These additional functionalities enhance employee management and contribute to a more efficient and engaged workforce. OnPay also provides access to payroll experts and compliance resources, offering support for businesses navigating complex industry-specific payroll issues.

Unlike Gusto, which offers a broader range of HR features, OnPay is primarily focused on payroll and its specialized support for specific industries. While ADP provides a more comprehensive suite of HR services, OnPay offers a more tailored and cost-effective solution for businesses with unique payroll needs.

Key Features:

- Automated payroll processing for accurate and timely payments.

- Tax filing and compliance management to avoid penalties.

- Direct deposit and employee self-service portals for convenience.

- Tip credit calculations for restaurants.

- Agricultural payroll support for farms.

- Non-profit accounting tools for non-profit organizations.

Pricing:

Starting at $40/month + $6 per person

Free plan: No free plan

Premium: No premium plan

Enterprise: Custom pricing

Best For: Businesses in industries with unique payroll needs, such as restaurants, farms, and non-profits.

Patriot Software – Best for Budget-Conscious Businesses

Patriot Software is a payroll platform known for its affordability and ease of use, making it an ideal choice for budget-conscious businesses. It offers essential payroll features at a competitive price, allowing small businesses to manage payroll efficiently without breaking the bank. Patriot Software’s straightforward interface and transparent pricing make it accessible to business owners with limited payroll experience.

Patriot Software automates payroll calculations, tax filings, and employee payments, reducing the risk of errors and ensuring compliance with federal, state, and local regulations. The platform also offers direct deposit, employee self-service portals, and customizable reports. Its integration with accounting software such as QuickBooks streamlines financial management and provides real-time insights into payroll expenses.

In addition to payroll, Patriot Software offers features such as time tracking and HR add-ons. These additional functionalities enhance employee management and contribute to a more efficient and engaged workforce. Patriot Software also provides access to payroll experts and compliance resources, offering support for businesses navigating complex employment laws.

Unlike Gusto, which offers a broader range of HR features, Patriot Software is primarily focused on payroll and its affordability. While ADP provides a more comprehensive suite of HR services, Patriot Software offers a more streamlined and cost-effective solution for small businesses on a budget.

Key Features:

- Automated payroll processing for accurate and timely payments.

- Tax filing and compliance management to avoid penalties.

- Direct deposit and employee self-service portals for convenience.

- Time tracking integration for accurate payroll calculations.

- HR add-ons for additional employee management features.

Pricing:

Starting at $17/month + $4 per person

Free plan: No free plan

Premium: Custom pricing

Enterprise: Custom pricing

Best For: Budget-conscious businesses looking for an affordable and easy-to-use payroll solution.

Square Payroll – Best for Square Ecosystem Users

Square Payroll is a payroll platform designed for businesses already using the Square ecosystem. It integrates seamlessly with Square POS and other Square services, providing a unified platform for managing sales, payments, and payroll. Square Payroll’s integration with Square’s ecosystem makes it a convenient choice for businesses already invested in Square’s services.

Square Payroll automates payroll calculations, tax filings, and employee payments, reducing the risk of errors and ensuring compliance with federal, state, and local regulations. The platform also offers direct deposit, employee self-service portals, and customizable reports. Its integration with Square POS streamlines sales data and provides real-time insights into payroll expenses.

In addition to payroll, Square Payroll offers features such as time tracking and employee benefits administration. These additional functionalities enhance employee management and contribute to a more efficient and engaged workforce. Square Payroll also provides access to payroll experts and compliance resources, offering support for businesses navigating complex employment laws.

Unlike Gusto, which offers a broader range of HR features, Square Payroll is primarily focused on payroll and its integration with the Square ecosystem. While ADP provides a more comprehensive suite of HR services, Square Payroll offers a more streamlined and cost-effective solution for businesses already using Square’s services.

Key Features:

- Automated payroll processing for accurate and timely payments.

- Tax filing and compliance management to avoid penalties.

- Direct deposit and employee self-service portals for convenience.

- Seamless integration with Square POS and other Square services.

- Time tracking integration for accurate payroll calculations.

- Employee benefits administration for managing health insurance and retirement plans.

Pricing:

Starting at $35/month + $5 per person

Free plan: No free plan

Premium: Custom pricing

Enterprise: Custom pricing

Best For: Businesses already using the Square ecosystem looking for a streamlined payroll solution.

Zoho Payroll – Best for Businesses Using Zoho Suite

Zoho Payroll is a payroll software designed for businesses that already use the Zoho suite of applications. It integrates seamlessly with Zoho Books and other Zoho apps, offering a unified platform for managing accounting, CRM, and payroll tasks. Zoho Payroll provides automated payroll processing, tax filing, and employee payment options.

Zoho Payroll automates payroll calculations, tax deductions, and filings, reducing the risk of errors and ensuring compliance with tax regulations. It also offers direct deposit, employee self-service portals, and mobile access. The platform integrates seamlessly with Zoho Books, allowing users to track payroll expenses, reconcile accounts, and generate financial reports from a single interface.

In addition to payroll, Zoho Payroll offers features such as time tracking, leave management, and employee onboarding. These additional functionalities enhance employee management and compliance. The platform also provides access to payroll experts and resources, offering support for businesses navigating complex payroll issues.

Unlike Gusto, which offers a broader range of HR features, Zoho Payroll is primarily focused on payroll and its integration with the Zoho suite. While ADP provides a more comprehensive suite of HR services, Zoho Payroll offers a more streamlined and cost-effective solution for businesses already using Zoho applications.

Key Features:

- Automated payroll processing with accurate tax calculations.

- Tax filing and compliance management to avoid penalties.

- Direct deposit and employee self-service portals for convenience.

- Seamless integration with Zoho Books and other Zoho apps.

- Time tracking integration for accurate payroll calculations.

- Leave management and employee onboarding.

Pricing:

Starting at $19/month for up to 5 employees

Free plan: No free plan

Premium: Custom pricing

Enterprise: Custom pricing

Best For: Businesses already using the Zoho suite of applications looking for a streamlined payroll solution.

Wagepoint – Best for Solopreneurs and Very Small Businesses

Wagepoint is a payroll solution tailored for solopreneurs and very small businesses. Its simplicity and ease of use make it ideal for those who need basic payroll functions without the complexity of larger systems. Wagepoint offers essential payroll features, including automated tax calculations, direct deposit, and employee self-service.

Wagepoint automates payroll calculations, tax filings, and employee payments, reducing the risk of errors and ensuring compliance with federal, state, and local regulations. The platform also offers direct deposit, employee self-service portals, and customizable reports. Its integration with accounting software such as QuickBooks and Xero streamlines financial management and provides real-time insights into payroll expenses.

Beyond payroll, Wagepoint offers features such as time tracking and basic HR functionalities. These additional functionalities enhance employee management and contribute to a more efficient and engaged workforce. Wagepoint also provides access to payroll experts and compliance resources, offering support for businesses navigating complex employment laws.

Unlike Gusto, which offers a broader range of HR features, Wagepoint is primarily focused on payroll and its simplicity for very small businesses. While ADP provides a more comprehensive suite of HR services, Wagepoint offers a more streamlined and cost-effective solution for solopreneurs and micro-businesses.

Key Features:

- Automated payroll processing for accurate and timely payments.

- Tax filing and compliance management to avoid penalties.

- Direct deposit and employee self-service portals for convenience.

- Time tracking integration for accurate payroll calculations.

- Basic HR functionalities for employee management.

Pricing:

Starting at $20/month + $6 per person

Free plan: No free plan

Premium: Custom pricing

Enterprise: Custom pricing

Best For: Solopreneurs and very small businesses needing a simple and easy-to-use payroll solution.

Xero Payroll – Best for Xero Accounting Users

Xero Payroll is a payroll platform designed to integrate seamlessly with Xero accounting software. This integration simplifies payroll management for businesses already using Xero, providing a unified platform for accounting and payroll tasks. It offers a range of features including automated payroll processing, tax filing, and employee payment options.

Xero Payroll automates payroll calculations, tax deductions, and filings, reducing the risk of errors and ensuring compliance with tax regulations. It also offers direct deposit, employee self-service portals, and mobile access. The platform integrates seamlessly with Xero accounting, allowing users to track payroll expenses, reconcile accounts, and generate financial reports from a single interface.

In addition to payroll, Xero Payroll offers features such as time tracking, leave management, and employee onboarding. These additional functionalities enhance employee management and compliance. The platform also provides access to payroll experts and resources, offering support for businesses navigating complex payroll issues.

Unlike Gusto, which offers a broader range of HR features, Xero Payroll is primarily focused on payroll and its integration with Xero accounting. While ADP provides a more comprehensive suite of HR services, Xero Payroll offers a more streamlined and cost-effective solution for businesses already using Xero.

Key Features:

- Automated payroll processing with accurate tax calculations.

- Tax filing and compliance management to avoid penalties.

- Direct deposit and employee self-service portals for convenience.

- Seamless integration with Xero accounting.

- Time tracking integration for accurate payroll calculations.

- Leave management and employee onboarding.

Pricing:

Starting at $40/month

Free plan: No free plan

Premium: Custom pricing

Enterprise: Custom pricing

Best For: Businesses already using Xero accounting software looking for a streamlined payroll solution.

DIY Payroll Software Comparison

Here’s a side-by-side comparison of the top DIY payroll solutions.

| Software | Best For | Starting Price | Key Features | Integrations | Free Plan |

|---|---|---|---|---|---|

| Gusto | Small Businesses with Growing Teams | $40/month + $6/person | Automated payroll, tax filing, direct deposit, employee self-service, benefits administration, time tracking, HR support | QuickBooks, Xero | No |

| QuickBooks Payroll | QuickBooks Users | $45/month + $6/person | Automated payroll, tax filing, direct deposit, employee self-service, time tracking, workers’ compensation administration, HR support | QuickBooks Online, QuickBooks Desktop | No |

| Paychex | Medium to Large Businesses | $59/month + $4/employee | Automated payroll, tax filing, direct deposit, employee self-service, benefits administration, time and attendance tracking, HR consulting | QuickBooks, Xero | No |

| ADP | Enterprises with Complex HR Needs | Custom Pricing | Automated payroll, tax filing, direct deposit, employee self-service, benefits administration, talent management, workforce management, HR outsourcing | SAP, Oracle | No |

| OnPay | Industries with Unique Payroll Needs | $40/month + $6/person | Automated payroll, tax filing, direct deposit, employee self-service, tip credit calculations, agricultural payroll support, non-profit accounting tools | QuickBooks, Xero | No |

| Patriot Software | Budget-Conscious Businesses | $17/month + $4/person | Automated payroll, tax filing, direct deposit, employee self-service, time tracking, HR add-ons | QuickBooks | No |

| Square Payroll | Square Ecosystem Users | $35/month + $5/person | Automated payroll, tax filing, direct deposit, employee self-service, integration with Square POS, time tracking, employee benefits administration | Square POS | No |

| Zoho Payroll | Businesses Using Zoho Suite | $19/month for 5 employees | Automated payroll, tax filing, direct deposit, employee self-service, integration with Zoho Books, time tracking, leave management, employee onboarding | Zoho Books | No |

| Wagepoint | Solopreneurs and Very Small Businesses | $20/month + $6/person | Automated payroll, tax filing, direct deposit, employee self-service, time tracking, basic HR functionalities | QuickBooks, Xero | No |

| Xero Payroll | Xero Accounting Users | $40/month | Automated payroll, tax filing, direct deposit, employee self-service, integration with Xero accounting, time tracking, leave management, employee onboarding | Xero | No |

How to Choose the Right DIY Payroll Software

Selecting the appropriate do-it-yourself payroll software requires careful consideration of your business’s specific needs and priorities. Here are key factors to evaluate during the selection process.

Assess Your Specific Needs: Start by identifying your business’s unique payroll requirements, such as the number of employees, pay frequency, and any industry-specific considerations. This will help you narrow down the options and find a platform that meets your specific needs.

Evaluate Integration Requirements: Consider how the payroll software will integrate with your existing accounting and HR systems. Seamless integration can streamline data flow and reduce manual data entry, saving time and reducing errors.

Consider User Experience: Choose a platform with a user-friendly interface and intuitive navigation. A simple and easy-to-use interface can make payroll processing more efficient and reduce the learning curve for new users.

Check Scalability Options: Ensure the software can scale with your business as it grows. Look for platforms that offer flexible pricing plans and can accommodate an increasing number of employees and payroll complexities.

Review Pricing Models: Compare the pricing models of different payroll software providers. Consider the monthly fees, per-employee costs, and any additional charges for features or support.

Test with Free Trials: Take advantage of free trials or demos to test the software before committing to a subscription. This allows you to evaluate its features, user interface, and overall suitability for your business.

Read Reviews & Case Studies: Research online reviews and case studies to gain insights into the experiences of other businesses using the software. This can help you identify potential strengths and weaknesses of each platform.

DIY Payroll Software Best Practices

Implementing and maintaining do-it-yourself payroll software effectively requires adherence to best practices. These guidelines ensure accuracy, compliance, and efficiency in payroll management.

Start with Clear Requirements: Define your specific payroll needs and requirements before selecting a software solution. This will help you choose a platform that meets your business’s unique needs and avoid unnecessary features or complexities.

Involve Key Stakeholders Early: Include relevant stakeholders, such as HR staff and accountants, in the software selection and implementation process. This ensures that the chosen platform meets the needs of all users and aligns with the company’s overall financial strategy.

Plan for Proper Training: Provide adequate training to all employees who will be using the payroll software. This ensures they understand how to use the platform effectively and can perform payroll tasks accurately.

Monitor Adoption Metrics: Track key adoption metrics, such as user engagement and task completion rates, to assess the effectiveness of the software implementation. This helps identify areas for improvement and ensures that the platform is being used to its full potential.

Leverage Automation Features: Take advantage of the automation features offered by the payroll software to streamline tasks and reduce manual effort. This includes automating payroll calculations, tax filings, and employee payments.

Maintain Data Quality: Regularly review and update employee data to ensure accuracy and compliance. This includes verifying employee contact information, tax withholding elections, and bank account details.

Schedule Regular Reviews: Conduct periodic reviews of your payroll processes and software configuration to identify areas for optimization and improvement. This helps ensure that your payroll system remains efficient and compliant with evolving regulations.

Finding Your Perfect Payroll Match

Selecting the right do-it-yourself payroll software is a critical decision for any business. The ideal solution should align with your company’s specific needs, budget, and long-term goals. Platforms like Gusto and QuickBooks Payroll offer excellent options for small to medium-sized businesses, while Paychex and ADP cater to larger enterprises with more complex HR requirements. By carefully evaluating your options and implementing best practices, you can streamline your payroll processes, ensure compliance, and focus on growing your business in 2025 and beyond.

Frequently Asked Questions

What is do-it-yourself payroll software?

Do-it-yourself payroll software is a type of program that allows business owners to manage their payroll processes internally, including calculating wages, withholding taxes, and issuing payments to employees, without relying on a third-party payroll service.

How much does do-it-yourself payroll software cost?

The cost of do-it-yourself payroll software varies depending on the provider and the features included. Some software charges a monthly fee plus a per-employee fee, while others offer tiered pricing plans based on the number of employees or the level of functionality.

Is do-it-yourself payroll software suitable for small businesses?

Yes, do-it-yourself payroll software can be a cost-effective and efficient solution for small businesses that want to manage their payroll in-house. Many software options are designed specifically for small businesses and offer user-friendly interfaces and affordable pricing plans.

Can do-it-yourself payroll software handle tax filings?

Yes, most do-it-yourself payroll software solutions are equipped to handle federal, state, and local tax filings. The software automatically calculates and withholds taxes, generates tax forms, and can even electronically file taxes with the appropriate government agencies.

What are the benefits of using do-it-yourself payroll software?

The benefits of using do-it-yourself payroll software include cost savings compared to outsourcing payroll, greater control over the payroll process, improved accuracy and compliance, and increased efficiency through automation.

How secure is do-it-yourself payroll software?

Reputable do-it-yourself payroll software providers employ robust security measures to protect sensitive employee and financial data. These measures include encryption, multi-factor authentication, and regular security audits to ensure data privacy and prevent unauthorized access.

User forum

0 messages