10 Best Sales Tax Software in 2025

Navigating the complexities of sales tax compliance can be a significant burden for businesses of all sizes. Calculating, collecting, and remitting sales tax across various jurisdictions with differing rules and rates consumes valuable time and resources, diverting attention from core business activities. This is especially true for e-commerce businesses operating nationwide, where sales tax obligations can become overwhelming. Sales tax automation software provides a solution to streamline these processes, reduce errors, and ensure compliance.

This article provides a detailed overview of the top 10 sales tax software solutions available in 2025. We will examine key features, pricing, and benefits to help you choose the right tool for your specific business needs. By automating sales tax management, businesses can minimize risk, improve efficiency, and focus on growth. These sales tax tools will help simplify the sales tax process and keep your business compliant.

Why is sales tax software needed?

The landscape of sales tax compliance is fraught with challenges. Businesses face a constantly evolving set of regulations, rates, and rules across thousands of jurisdictions. The need to stay updated on these changes, accurately calculate taxes, and file returns on time creates a significant administrative burden. Failing to comply can result in costly penalties and audits.

- Complex Jurisdictional Rules: Different states, counties, and cities have their own sales tax laws, creating a maze of regulations to navigate.

- Changing Tax Rates: Sales tax rates are subject to change, requiring businesses to constantly monitor and update their systems.

- Product Taxability Rules: Determining whether a product is taxable can be complex, as rules vary by jurisdiction and product type.

- Nexus Determination: Understanding when your business has a physical or economic presence (nexus) in a state, triggering sales tax obligations, is critical.

- Audit Risk: Inaccurate sales tax calculations or filings can lead to audits, which can be time-consuming and expensive.

Sales tax software offers a solution by automating these processes, reducing the risk of errors, and freeing up resources for other business priorities. By centralizing sales tax management, businesses can ensure compliance and focus on their core operations.

Key Features to Look For

When selecting sales tax software, several key features can significantly impact its effectiveness and value. These features automate calculations, streamline compliance, and provide valuable insights into your sales tax obligations.

Automated Sales Tax Calculation:

The software should automatically calculate sales tax based on the customer’s location, product taxability rules, and current tax rates. This eliminates manual calculations and reduces the risk of errors.

Nexus Tracking:

The software should help you track your nexus obligations across different states, based on your sales volume and economic activity. This ensures you are only collecting and remitting sales tax in states where you have a legal obligation.

Sales Tax Reporting and Filing:

The software should generate accurate sales tax reports and automate the filing process, saving you time and reducing the risk of penalties. This includes generating the correct forms and submitting them to the appropriate tax agencies.

Exemption Certificate Management:

The software should allow you to manage exemption certificates from customers who are exempt from sales tax. This ensures you are not charging sales tax to exempt customers and can easily provide documentation during an audit.

Integration with Accounting and E-commerce Platforms:

The software should seamlessly integrate with your existing accounting and e-commerce platforms, such as QuickBooks, Shopify, and Magento. This allows for automated data transfer and eliminates the need for manual data entry.

Benefits

Implementing sales tax software can bring several benefits to your business, improving efficiency, reducing risk, and freeing up resources. These advantages can translate into significant cost savings and improved compliance.

Reduced Audit Risk:

By automating sales tax calculations and filings, the software minimizes the risk of errors and penalties, reducing the likelihood of an audit. Accurate and timely filings demonstrate compliance and minimize potential scrutiny.

Increased Efficiency:

Automating sales tax processes frees up valuable time and resources, allowing your team to focus on other business priorities. Manual calculations and filings can be time-consuming, but automation streamlines these tasks.

Improved Accuracy:

Sales tax software ensures accurate calculations and filings, reducing the risk of errors and penalties. Automated systems are less prone to human error, leading to more reliable results.

Simplified Compliance:

The software simplifies the complex process of sales tax compliance, ensuring you are following the latest rules and regulations. Staying up-to-date with changing tax laws can be challenging, but the software handles these updates automatically.

Scalability:

Sales tax software can scale with your business, accommodating increasing sales volume and expanding nexus obligations. As your business grows, the software can adapt to handle the increased complexity of sales tax management.

What Is the Best Sales Tax Software?

Avalara AvaTax – Best for Enterprise Businesses

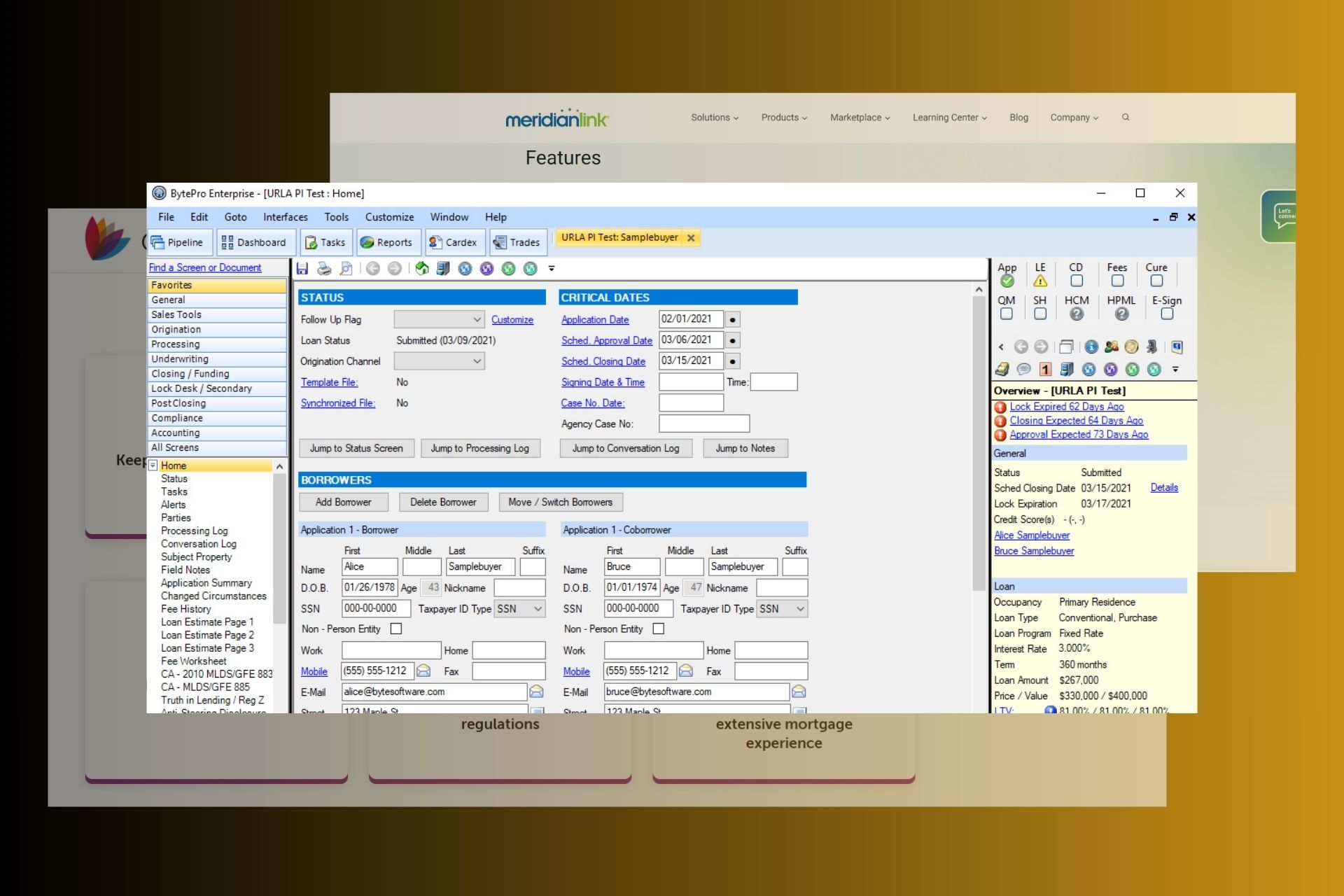

AvaTax is a comprehensive sales tax automation solution designed for businesses of all sizes, especially larger enterprises with complex sales tax requirements. It offers accurate tax calculations, automated filing, and robust reporting capabilities. AvaTax integrates with hundreds of accounting, e-commerce, and ERP systems, providing a unified platform for sales tax management.

AvaTax boasts a vast database of tax rules and rates, ensuring accurate tax calculations in real-time. Its advanced nexus determination tools help businesses identify their sales tax obligations across different states. The software also automates the filing process, generating accurate returns and submitting them to the appropriate tax agencies. This reduces the risk of errors and penalties, saving businesses time and money.

Beyond the core features, AvaTax offers advanced functionalities such as exemption certificate management, audit support, and detailed reporting. The exemption certificate management tool allows businesses to easily manage and validate exemption certificates from customers. The audit support feature provides access to a team of sales tax experts who can assist with audits. AvaTax’s detailed reporting capabilities provide insights into your sales tax obligations, helping you make informed decisions.

Compared to TaxJar, which is better suited for smaller businesses, AvaTax is designed for larger organizations with more complex needs. While Avalara offers a broader range of features, TaxJar is often more affordable for smaller businesses. Unlike Vertex, which focuses primarily on enterprise-level solutions, Avalara caters to a wider range of business sizes.

Key Features:

- Real-time tax calculation with precise location determination

- Automated sales tax returns filing and remittance

- Nexus determination to identify sales tax obligations

- Exemption certificate management for tax-exempt customers

- Detailed reporting and analytics for insights into sales tax liabilities

Pricing:

Starting at $500/month

Free plan: Not available

Premium: Custom pricing

Enterprise: Custom pricing

Best For: Large enterprises with complex sales tax requirements and a need for comprehensive automation.

TaxJar – Best for E-commerce Businesses

TaxJar is a user-friendly sales tax automation platform specifically designed for e-commerce businesses. It simplifies sales tax calculations, reporting, and filing, making it easy for online retailers to stay compliant. TaxJar integrates seamlessly with popular e-commerce platforms like Shopify, Amazon, and WooCommerce.

TaxJar automatically calculates sales tax based on the customer’s location and product taxability rules. It provides real-time tax rates and ensures accurate calculations at the point of sale. The software also generates detailed sales tax reports, making it easy to file returns with state and local tax agencies. TaxJar’s AutoFile feature automates the filing process, submitting returns on your behalf.

In addition to its core features, TaxJar offers tools for managing economic nexus, tracking sales tax liabilities, and handling marketplace facilitator laws. The economic nexus insights help businesses understand when they have a sales tax obligation in a particular state based on their sales volume. TaxJar also provides resources and support to help businesses navigate marketplace facilitator laws, which can be complex. The user interface is intuitive, making it easy for e-commerce businesses to manage their sales tax obligations.

Compared to Avalara, TaxJar is more focused on e-commerce businesses and offers a simpler, more streamlined user experience. While Avalara provides a broader range of features, TaxJar is often more affordable for smaller e-commerce businesses. Unlike Vertex, which is primarily geared towards larger enterprises, TaxJar is designed for small to medium-sized online retailers.

Key Features:

- Automated sales tax calculations for e-commerce transactions

- Sales tax returns filing and remittance automation

- Economic nexus insights and tracking

- Integration with popular e-commerce platforms

- Real-time sales tax rates and reporting

Pricing:

Starting at $19/month

Free plan: Not available

Premium: Custom pricing

Enterprise: Custom pricing

Best For: Small to medium-sized e-commerce businesses looking for a user-friendly and affordable sales tax automation solution.

Vertex – Best for Large Corporations

Vertex is a robust sales tax automation solution designed for large corporations with complex sales tax requirements. It offers advanced tax calculation, compliance, and reporting capabilities. Vertex integrates with leading ERP systems like SAP and Oracle, providing a comprehensive platform for managing sales tax across the enterprise.

Vertex provides accurate tax calculations based on a vast database of tax rules and rates. Its advanced tax engine supports complex tax scenarios, such as product taxability rules, sourcing rules, and tax holidays. The software also automates the filing process, generating accurate returns and submitting them to the appropriate tax agencies. This reduces the risk of errors and penalties, saving businesses time and money.

In addition to its core features, Vertex offers advanced functionalities such as global tax management, audit support, and detailed reporting. The global tax management feature allows businesses to manage sales tax across multiple countries. The audit support feature provides access to a team of tax experts who can assist with audits. Vertex’s detailed reporting capabilities provide insights into your sales tax obligations, helping you make informed decisions.

Compared to Avalara, Vertex is more focused on large corporations and offers a more comprehensive set of features for managing complex tax scenarios. While Avalara caters to a wider range of business sizes, Vertex is designed for the specific needs of large enterprises. Unlike TaxJar, which is geared towards e-commerce businesses, Vertex provides a broader range of tax management capabilities.

Key Features:

- Advanced tax calculation engine for complex tax scenarios

- Automated sales tax returns filing and remittance

- Global tax management for multinational corporations

- Integration with leading ERP systems

- Detailed reporting and analytics for insights into sales tax liabilities

Pricing:

Starting at $1,000/month

Free plan: Not available

Premium: Custom pricing

Enterprise: Custom pricing

Best For: Large corporations with complex sales tax requirements and a need for a comprehensive tax management platform.

Sovos – Best for Global Compliance

Sovos offers a comprehensive suite of tax compliance solutions, including sales tax automation. It provides accurate tax calculations, automated filing, and robust reporting capabilities. Sovos supports businesses operating in multiple countries, making it a good choice for global companies.

Sovos automates sales tax calculations based on the customer’s location, product taxability rules, and current tax rates. It provides real-time tax rates and ensures accurate calculations at the point of sale. The software also generates detailed sales tax reports, making it easy to file returns with state and local tax agencies. Sovos’s automated filing feature streamlines the filing process, submitting returns on your behalf.

Beyond sales tax, Sovos offers solutions for VAT, excise tax, and other compliance requirements. This makes it a one-stop shop for businesses with diverse tax obligations. Sovos also offers advanced features such as audit support, exemption certificate management, and detailed reporting. The audit support feature provides access to a team of tax experts who can assist with audits. Sovos’s detailed reporting capabilities provide insights into your sales tax obligations.

Compared to Avalara, Sovos is more focused on global compliance and offers a broader range of tax solutions. While Avalara provides a strong sales tax automation platform, Sovos caters to businesses with more diverse tax needs. Unlike TaxJar, which is geared towards e-commerce businesses, Sovos provides a broader range of tax management capabilities.

Key Features:

- Global tax compliance solutions for sales tax, VAT, and excise tax

- Automated sales tax calculations and returns filing

- Support for businesses operating in multiple countries

- Exemption certificate management

- Detailed reporting and analytics for insights into tax liabilities

Pricing:

Starting at $600/month

Free plan: Not available

Premium: Custom pricing

Enterprise: Custom pricing

Best For: Businesses operating in multiple countries and needing a comprehensive tax compliance solution.

AccurateTax – Best for Small Businesses with Fixed Locations

AccurateTax is a sales tax solution tailored for small businesses primarily operating from fixed locations. It simplifies sales tax calculations and reporting for businesses with less complex needs. It offers a straightforward interface and basic features at a competitive price point.

AccurateTax calculates sales tax based on location and product taxability rules, ensuring compliance with local regulations. It generates reports that can be used for filing sales tax returns. The software is designed to be easy to use, making it accessible to small business owners without extensive accounting expertise.

While AccurateTax offers essential sales tax features, it lacks the advanced capabilities of comprehensive platforms like Avalara or Vertex. It does not offer nexus tracking or automated filing. However, it’s a cost-effective option for small businesses with simple sales tax needs.

Compared to TaxJar, AccurateTax is more focused on businesses with fixed locations and less complex sales tax requirements. While TaxJar provides a broader range of features and integrations, AccurateTax is often more affordable for small businesses with simple needs. Unlike Sovos, which is designed for global compliance, AccurateTax focuses on domestic sales tax compliance.

Key Features:

- Sales tax calculation based on location and product taxability

- Sales tax reporting

- Simple and easy-to-use interface

- Affordable pricing for small businesses

Pricing:

Starting at $29/month

Free plan: Not available

Premium: Custom pricing

Enterprise: Custom pricing

Best For: Small businesses with fixed locations and simple sales tax requirements.

Zoho CRM – Best for Integrated CRM and Sales Tax Management

Zoho CRM offers sales tax management features as part of its comprehensive customer relationship management (CRM) platform. It allows businesses to calculate sales tax within the CRM system, streamlining sales processes and ensuring accurate tax collection. It’s ideal for businesses already using Zoho CRM or looking for an integrated solution.

Zoho CRM calculates sales tax based on location and product taxability rules, providing accurate tax calculations at the point of sale. It integrates with Zoho Books, allowing businesses to manage sales tax reporting and filing within the Zoho ecosystem. The CRM system also allows businesses to track customer tax exemptions and apply them automatically to sales transactions.

While Zoho CRM offers sales tax features, it lacks the advanced capabilities of dedicated sales tax software like Avalara or TaxJar. It does not offer nexus tracking or automated filing. However, it’s a convenient option for businesses already using Zoho CRM or looking for an integrated solution.

Compared to TaxJar, Zoho CRM is more focused on providing a comprehensive CRM solution with integrated sales tax features. While TaxJar provides a broader range of sales tax-specific features, Zoho CRM offers a wider range of CRM capabilities. Unlike Vertex, which is designed for large corporations, Zoho CRM is suitable for small to medium-sized businesses.

Key Features:

- Sales tax calculation within the CRM system

- Integration with Zoho Books for sales tax reporting and filing

- Customer tax exemption tracking and application

- Comprehensive CRM features for managing customer relationships

Pricing:

Starting at $20/user/month

Free plan: Available with limited features

Premium: Custom pricing

Enterprise: Custom pricing

Best For: Businesses already using Zoho CRM or looking for an integrated CRM and sales tax management solution.

Wolters Kluwer CCH SureTax – Best for Complex Tax Determinations

Wolters Kluwer CCH SureTax is a sales tax automation solution designed for businesses with complex tax determination needs. It offers advanced tax calculation capabilities, support for various tax types, and integration with leading ERP systems. It’s suitable for businesses operating in highly regulated industries or with complex product taxability rules.

CCH SureTax provides accurate tax calculations based on a vast database of tax rules and rates. Its advanced tax engine supports complex tax scenarios, such as product taxability rules, sourcing rules, and tax holidays. The software also automates the filing process, generating accurate returns and submitting them to the appropriate tax agencies.

In addition to its core features, CCH SureTax offers advanced functionalities such as global tax management, audit support, and detailed reporting. The global tax management feature allows businesses to manage sales tax across multiple countries. The audit support feature provides access to a team of tax experts who can assist with audits. CCH SureTax’s detailed reporting capabilities provide insights into your sales tax obligations, helping you make informed decisions.

Compared to Avalara, CCH SureTax is more focused on complex tax determinations and offers a more comprehensive set of features for managing various tax types. While Avalara caters to a wider range of business sizes, CCH SureTax is designed for businesses with complex tax needs. Unlike TaxJar, which is geared towards e-commerce businesses, CCH SureTax provides a broader range of tax management capabilities.

Key Features:

- Advanced tax calculation engine for complex tax determinations

- Support for various tax types, including sales tax, VAT, and excise tax

- Integration with leading ERP systems

- Global tax management for multinational corporations

- Detailed reporting and analytics for insights into tax liabilities

Pricing:

Starting at $800/month

Free plan: Not available

Premium: Custom pricing

Enterprise: Custom pricing

Best For: Businesses with complex tax determination needs and a need for a comprehensive tax management platform.

Sales Tax DataLINK – Best for Custom Integrations

Sales Tax DataLINK specializes in providing sales tax data and custom integration solutions. It offers a range of services, including sales tax rate data, product taxability matrices, and custom API integrations. It’s ideal for businesses needing highly customized sales tax solutions.

Sales Tax DataLINK provides accurate and up-to-date sales tax rate data, ensuring compliance with local regulations. Its product taxability matrices help businesses determine the taxability of their products based on jurisdiction and product type. The company also offers custom API integrations, allowing businesses to integrate sales tax data and functionality into their existing systems.

While Sales Tax DataLINK offers valuable sales tax data and integration services, it lacks the comprehensive automation features of platforms like Avalara or TaxJar. It does not offer nexus tracking or automated filing. However, it’s a good choice for businesses needing highly customized sales tax solutions.

Compared to TaxJar, Sales Tax DataLINK is more focused on providing sales tax data and custom integrations. While TaxJar provides a broader range of sales tax automation features, Sales Tax DataLINK offers more flexibility in terms of customization. Unlike Vertex, which is designed for large corporations, Sales Tax DataLINK is suitable for businesses of all sizes needing custom solutions.

Key Features:

- Accurate and up-to-date sales tax rate data

- Product taxability matrices

- Custom API integrations

- Flexible and customizable solutions

Pricing:

Starting at $300/month

Free plan: Not available

Premium: Custom pricing

Enterprise: Custom pricing

Best For: Businesses needing highly customized sales tax solutions and data.

Service Objects DOTS Address Validation – Best for Address Accuracy

Service Objects DOTS Address Validation is a solution that focuses on ensuring address accuracy, which is crucial for precise sales tax calculation. While not a complete sales tax solution, it integrates with other tools to provide accurate location data for sales tax determination. It is most valuable for businesses where precise location identification is essential for compliance.

DOTS Address Validation verifies and standardizes customer addresses, ensuring that sales tax is calculated based on the correct location. This helps businesses avoid errors and penalties associated with inaccurate sales tax calculations. The software also provides address correction and geocoding services, further improving address accuracy.

While DOTS Address Validation is a valuable tool for ensuring address accuracy, it does not offer the comprehensive sales tax automation features of platforms like Avalara or TaxJar. It does not offer nexus tracking or automated filing. However, it’s a good choice for businesses needing to improve address accuracy for sales tax purposes.

Compared to TaxJar, DOTS Address Validation is more focused on address accuracy and does not offer the same range of sales tax automation features. While TaxJar provides a broader range of sales tax-specific features, DOTS Address Validation offers more specialized address validation capabilities. Unlike Vertex, which is designed for large corporations, DOTS Address Validation is suitable for businesses of all sizes needing to improve address accuracy.

Key Features:

- Address verification and standardization

- Address correction

- Geocoding

- Improved address accuracy for sales tax calculation

Pricing:

Starting at $50/month

Free plan: Available with limited features

Premium: Custom pricing

Enterprise: Custom pricing

Best For: Businesses needing to improve address accuracy for sales tax calculation and other purposes.

Thomson Reuters ONESOURCE – Best for Large Multinationals

Thomson Reuters ONESOURCE offers a comprehensive suite of tax solutions, including sales tax automation. It provides advanced tax calculation, compliance, and reporting capabilities. ONESOURCE is designed for large multinational corporations with complex tax requirements.

ONESOURCE provides accurate tax calculations based on a vast database of tax rules and rates. Its advanced tax engine supports complex tax scenarios, such as product taxability rules, sourcing rules, and tax holidays. The software also automates the filing process, generating accurate returns and submitting them to the appropriate tax agencies.

In addition to its core features, ONESOURCE offers advanced functionalities such as global tax management, audit support, and detailed reporting. The global tax management feature allows businesses to manage sales tax across multiple countries. The audit support feature provides access to a team of tax experts who can assist with audits. ONESOURCE’s detailed reporting capabilities provide insights into your sales tax obligations.

Compared to Avalara, ONESOURCE is more focused on large multinational corporations and offers a more comprehensive set of features for managing complex tax scenarios. While Avalara caters to a wider range of business sizes, ONESOURCE is designed for the specific needs of large enterprises. Unlike TaxJar, which is geared towards e-commerce businesses, ONESOURCE provides a broader range of tax management capabilities.

Key Features:

- Advanced tax calculation engine for complex tax scenarios

- Automated sales tax returns filing and remittance

- Global tax management for multinational corporations

- Integration with leading ERP systems

- Detailed reporting and analytics for insights into tax liabilities

Pricing:

Starting at $1,200/month

Free plan: Not available

Premium: Custom pricing

Enterprise: Custom pricing

Best For: Large multinational corporations with complex sales tax requirements and a need for a comprehensive tax management platform.

Sales Tax Software Comparison

Here’s a side-by-side comparison of the top solutions.

| Software | Best For | Starting Price | Key Features | Integrations | Free Plan |

|---|---|---|---|---|---|

| Avalara AvaTax | Enterprise Businesses | $500/month | Real-time tax calculation, automated filing, nexus determination | Hundreds of platforms | No |

| TaxJar | E-commerce Businesses | $19/month | Automated calculations, reporting, economic nexus insights | Shopify, Amazon, WooCommerce | No |

| Vertex | Large Corporations | $1,000/month | Advanced tax engine, global tax management, ERP integration | SAP, Oracle | No |

| Sovos | Global Compliance | $600/month | Global tax compliance, automated filing, support for multiple countries | Various platforms | No |

| AccurateTax | Small Businesses with Fixed Locations | $29/month | Sales tax calculation, reporting, simple interface | Limited | No |

| Zoho CRM | Integrated CRM and Sales Tax Management | $20/user/month | Sales tax calculation, Zoho Books integration, customer exemption tracking | Zoho ecosystem | Yes (limited) |

| Wolters Kluwer CCH SureTax | Complex Tax Determinations | $800/month | Advanced tax engine, support for various tax types, ERP integration | Various platforms | No |

| Sales Tax DataLINK | Custom Integrations | $300/month | Sales tax rate data, product taxability matrices, custom API integrations | Custom | No |

| Service Objects DOTS Address Validation | Address Accuracy | $50/month | Address verification, correction, geocoding | Various platforms | Yes (limited) |

| Thomson Reuters ONESOURCE | Large Multinationals | $1,200/month | Advanced tax engine, global tax management, ERP integration | Various platforms | No |

How to Choose the Right Sales Tax Software

Selecting the appropriate sales tax software requires careful consideration of your business’s specific needs and circumstances. Evaluate your requirements, budget, and technical capabilities to make an informed decision.

Assess Your Specific Needs:

Determine your business’s sales tax complexity, including the number of states where you have nexus, the volume of sales transactions, and the types of products or services you sell. This will help you identify the features and capabilities you need in a sales tax solution.

Evaluate Integration Requirements:

Ensure that the sales tax software integrates seamlessly with your existing accounting, e-commerce, and ERP systems. This will automate data transfer and eliminate the need for manual data entry, improving efficiency and accuracy.

Consider User Experience:

Choose a sales tax software with an intuitive and user-friendly interface. This will make it easier for your team to learn and use the software, reducing the risk of errors and improving productivity.

Check Scalability Options:

Select a sales tax software that can scale with your business as it grows. This will ensure that the software can accommodate increasing sales volume and expanding nexus obligations.

Review Pricing Models:

Compare the pricing models of different sales tax software solutions and choose one that fits your budget. Consider the total cost of ownership, including implementation fees, monthly subscription fees, and any additional charges.

Test with Free Trials:

Take advantage of free trials or demos offered by sales tax software vendors. This will allow you to test the software and ensure that it meets your specific needs before making a purchase.

Read Reviews & Case Studies:

Research online reviews and case studies to learn about the experiences of other businesses with different sales tax software solutions. This will provide valuable insights into the strengths and weaknesses of each software.

Sales Tax Software Best Practices

Implementing sales tax software effectively requires following best practices to ensure accuracy, compliance, and efficiency. These guidelines will help you maximize the value of your investment and minimize the risk of errors.

Start with Clear Requirements:

Define your specific sales tax requirements before implementing any software. This will help you choose the right solution and configure it properly.

Involve Key Stakeholders Early:

Involve key stakeholders from accounting, sales, and IT in the selection and implementation process. This will ensure that the software meets the needs of all departments and is properly integrated with existing systems.

Plan for Proper Training:

Provide adequate training to your team on how to use the sales tax software. This will ensure that they understand how to calculate sales tax, file returns, and manage exemption certificates.

Monitor Adoption Metrics:

Track key adoption metrics, such as the number of sales tax returns filed on time and the number of errors identified. This will help you identify areas for improvement and ensure that the software is being used effectively.

Leverage Automation Features:

Take advantage of the automation features offered by the sales tax software. This will reduce manual effort and improve accuracy.

Maintain Data Quality:

Ensure that your sales tax data is accurate and up-to-date. This includes maintaining accurate product taxability rules, customer addresses, and tax rates.

Schedule Regular Reviews:

Conduct regular reviews of your sales tax processes and software configuration. This will help you identify any potential issues and ensure that you are following the latest rules and regulations.

Making Your Software Choice

Selecting the right sales tax software is a critical decision that can significantly impact your business’s compliance, efficiency, and profitability. Based on the analysis, Avalara AvaTax and TaxJar stand out as leading solutions, each catering to different business needs. Avalara is best suited for enterprise businesses with complex requirements, while TaxJar is an excellent choice for e-commerce businesses seeking a user-friendly and affordable solution.

Ultimately, the best sales tax software for your business depends on your specific circumstances. Consider your needs, budget, and technical capabilities to make an informed decision and ensure compliance in 2025 and beyond. Implementing sales tax automation can streamline your operations, reduce risk, and free up resources for other business priorities.

Frequently Asked Questions

What is sales tax software?

Sales tax software is a tool that automates the calculation, collection, and reporting of sales tax. It helps businesses comply with sales tax laws and regulations by accurately calculating taxes, generating reports, and filing returns.

How does sales tax software work?

Sales tax software uses a database of tax rates and rules to calculate sales tax based on the customer’s location, product taxability, and other factors. It integrates with accounting and e-commerce systems to automate data transfer and streamline the sales tax process.

What are the benefits of using sales tax software?

Using sales tax software can reduce the risk of errors, improve efficiency, and save time. It helps businesses comply with sales tax laws and regulations, avoid penalties, and free up resources for other business priorities.

How much does sales tax software cost?

The cost of sales tax software varies depending on the features, functionality, and pricing model. Some software solutions offer monthly subscription fees, while others offer custom pricing based on the size and complexity of your business.

What are the key features to look for in sales tax software?

Key features to look for in sales tax software include automated tax calculation, nexus tracking, sales tax reporting and filing, exemption certificate management, and integration with accounting and e-commerce platforms.

Is sales tax software necessary for my business?

If your business collects sales tax, then sales tax software can be a valuable tool for ensuring compliance and improving efficiency. It is especially important for businesses with a high volume of sales transactions or nexus in multiple states.

User forum

0 messages